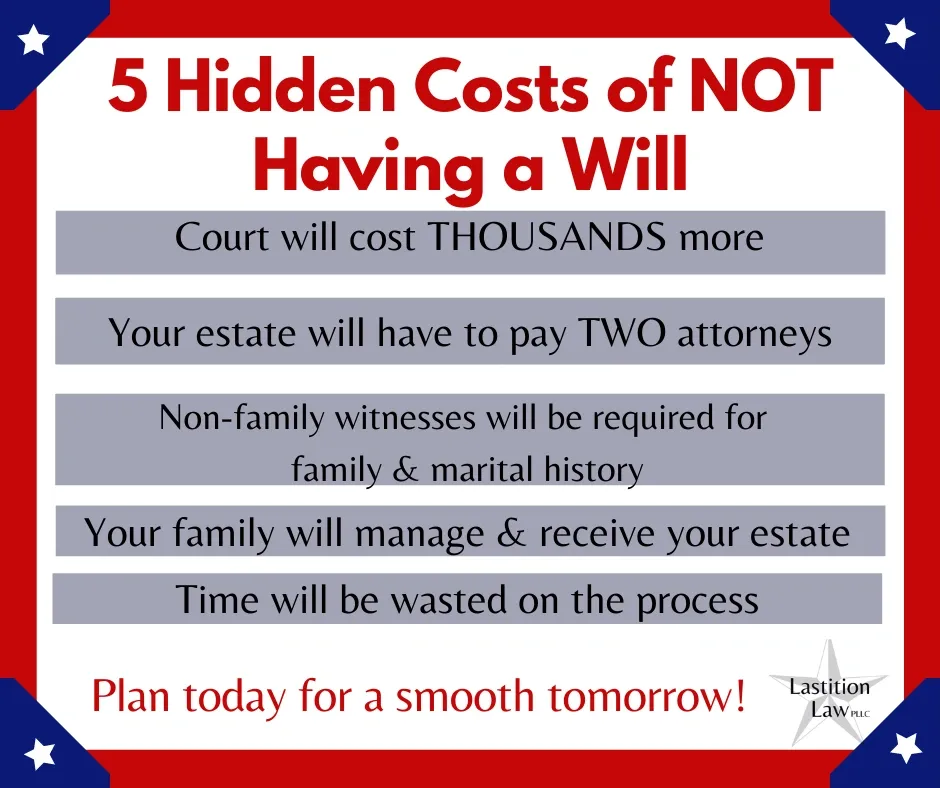

Don’t have a will? Think you don’t need one? You may need to think again. In this article, I break down hidden costs of NOT having a will in place.

1. The Court process (Probate) will likely be thousands of dollars more for your survivors

2. Your estate will have to pay TWO attorneys (because the state gets involved)

3. Witnesses will be necessary to confirm family history (can be hard to find and coordinate)

4. Your family will manage and receive your estate

5. Time will be wasted waiting for the court process

I expand on each of these a bit, below.

1. The Court process (probate) will likely be thousands of dollars more for your survivors

When you die with a will in place, you can expect that your family will spend about $1500-4,000, on average, based on today’s prices, on the court process (called probate) after you pass away. This process covers changing title on your assets, like your house, and anything else that needs to be transferred to your surviving family or designated beneficiaries.

When you die and have NO will in place, you can reasonably expect that your family or survivors will spend about twice as much as normal ($3,500-$6,000+) on the probate process because there are many more steps and hurdles to overcome compared to when there is a will in place.

So, when I say to clients “you can spend a little today to save a lot tomorrow” it is usually at least 200% true!

2. Your estate will have to pay TWO attorneys

In your will, you outline your family members. Without this “evidence” from you about who your family members are, the state needs to investigate. This costs money.

The judge will appoint an attorney to research your legal heirs (children, parents, spouses, etc) ($) and prepare a report for the judge ($) and appear at the hearing ($) to discuss their findings and represent any potentially excluded heirs.

Usually, this additional fee is about $500, but can vary widely based on the research necessary and the efforts that attorney has to expend to be in touch with potential heirs and witnesses (keep reading to learn more about the witnesses).

3. Witnesses will be necessary to confirm family history

Without the evidence of who your family members are in a will, the court will assign an attorney, discussed above to research, but will also need testimony from one or two witnesses as to who your family members are. Who are your children? Who were you and have you even been married to? Are your parents or siblings alive?

It’s increasingly difficult to find witnesses who have a thorough knowledge of these facts in our modern world. People move, and fall out of touch with those who know our whole history, leaving survivors in a difficult position with regard to finding someone who is not interested in the estate (meaning, usually, not a family member or anyone else who stands to receive anything from the estate) but who is familiar with the details of the decedent’s family and marital history. But, we must find these people and offer their testimony to the court.

The “cost” associated with this is threefold: Your family will be paying their attorney more for their time tracking down, and talking with potential witnesses, to decide if they have enough information to be a good witness. Your family will also spend their own time doing initial research to provide to the attorney regarding who these potential witnesses are and how to contact them. Those witnesses will need to take their own time to complete a short deposition, or will need to appear at a hearing, and sometimes both. This adds to legal costs, and personal requests for time and attention by people who stand to gain nothing beyond having helped your family with the probate process. Stay in touch with those friends, if you are planning to leave this earth without complete plans in place!

4. Your family will manage and receive your estate

In my business, I cast judgments aside. The reality is that for some people, you do not want your family involved in your affairs. If that rings true for you, stop reading, and contact me about your will. Without one, everything will likely not only go to your family, but will be managed by them, when you pass away.

Under Texas state law, where there is no valid will left behind, the law says that your family will step in to manage your estate and to receive it. For some people, this is of no concern and reflects their own goals (even in this case though, the other factors in this article will apply!). For others, however, this might be a nightmare for any number of reasons. Again, if this is you – and you do not want your family involved, or only want certain family members involved – you need to make getting your will in place a priority!

5. Time will be wasted waiting for the court process

By now, you see that there are many additional steps required in court when there is no will left behind. Those steps all add up to more time and more money. How much more time is very uncertain based on a number of factors. How quickly is the court handling cases, at this time? How quickly will the attorney assigned by the state complete their work/research? How cooperative will the witnesses be in getting the necessary information and documentation to and from them? How are hearings be handled, and at what pace? Are assets tied up due to issues with co-owners, etc? Are there debts affecting the estate?

There is an endless list of possibilities that can lead to significant delays in estate administration and probate, and neither you nor your family is aware of them all unless you have met with an experienced estate planning attorney and gotten a good understanding of how the process will play out, practically, for your family. I go through this analysis with each potential client I meet with. My goal in each consultation is to inform you about the processes that will be relevant for your family, the costs and potential risk factors, and the alternatives available to you. I put my clients in the driver’s seat for their planning, and help them prepare for their goals and wishes to be followed, as simply and economically as possible.

If you do already have your will or trust in place – Congratulations! You’ve taken a significant step towards saving your family as much time and money as you can. Everyone says they want things to be simple when they pass away – simplicity without planning for it is very rare, in my experience, so plan today for an easier tomorrow!